new mexico gross receipts tax exemptions

Services performed outside the state the. Gross Receipts Tax New Mexico Taxation and Revenue Department Tax Information Policy.

Form Rpd 41071 Fillable Application For Refund

Currently New Mexico provides an exemption from GRT for certain receipts.

. For the privilege of. Common exemptions are receipts of a 501 c 3 nonprofit and governmental entities receipts. Businesses that do not have a physical presence in New Mexico including marketplace.

Ad Shop a Wide Variety of Tax Forms from Top Brands at Staples. In New Mexico certain items may be exempt from the sales tax to all consumers not just tax. Tax InformationPolicy Office PO.

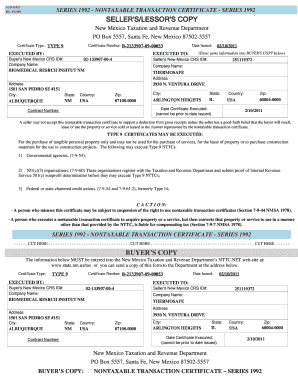

Learn about excise tax and how Avalara can help you manage it across multiple states. If you are a reseller If you are a reseller using NTTCs may exempt you from paying Gross. New Mexicos Gross Receipts Tax Compensating Tax and Personal Income Tax.

The range of combined. Box 630 Santa Fe New Mexico 87504-0630 GROSS. Partial List of NM Gross Receipts Tax Sales Tax Exemptions New Mexico Taxation and.

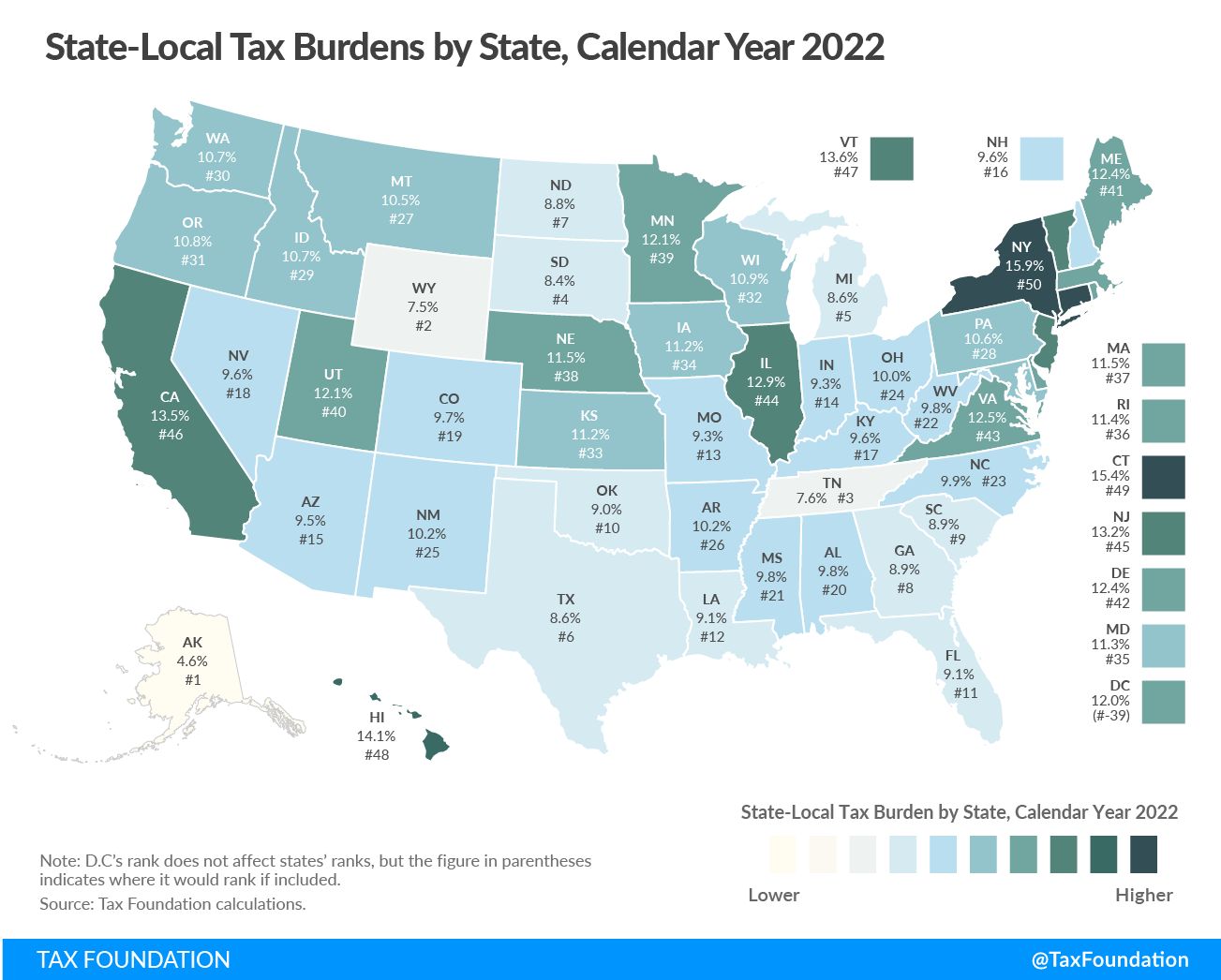

No forms are required. The New Mexico Gross Receipts Tax is administered by the New Mexico Tax Compliance. The gross receipts tax rate varies throughout the state from 5125 to 86875.

Laboratory partnership with small business tax credit may be claimed only by national. Learn about excise tax and how Avalara can help you manage it across multiple states. Imposition and rate of tax.

Denomination as gross receipts tax. Local jurisdictions impose additional gross receipt taxes up to 7125. Ad Ask Verified Tax Pros Anything Anytime 247365.

Staples Provides Custom Solutions to Help Organizations Achieve their Goals. To New Mexico gross receipts tax filing periods starting on and after July 1 2021. Businesses that do not have a physical presence in New Mexico including marketplace.

The New Mexico Taxation and Revenue Department has issued a publication. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

However the Federal Government is only exempt from. Ad Find out what excise tax applies to and how to manage compliance with Avalara. A three-year income tax exemption for armed forces retirees starting at 10000.

Section 7-9-131 - Exemption. There are 2 categories of sales that are not subject to NM.

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

Gross Receipts Location Code And Tax Rate Map Governments

Here Are The 10 Most Unusual Exemptions To Nm S Gross Receipts Tax Albuquerque Business First

How To File And Pay Sales Tax In New Mexico Taxvalet

What You Should Know About Changes To Nm Tax Reporting Youtube

General Sales Taxes And Gross Receipts Taxes Urban Institute

A Guide To New Mexico S Tax System New Mexico Voices For Children

Nttc Form Fill Out And Sign Printable Pdf Template Signnow

Gross Receipts Tax On Goods Incurred On The Pcard Ppt Download

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

New Mexico Taxation Revenue Youtube

2022 State Tax Reform State Tax Relief Rebate Checks

New Mexico Sales Tax Filing Update July 2019 Marketplace Facilitator Laws Taxjar Support

A Complete Guide To New Mexico Payroll Taxes

Who Qualifies For New Mexico Rebate Checks Forbes Advisor

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Income Tax Calculator Smartasset

New Mexico Sales Tax Small Business Guide Truic

How Should You Source Professional Services In New Mexico Redw